At GSG Wealth Management our strength is building a clear and comprehensive financial plan WITH our clients.

In our financial planning, we do a deep and thoughtful analysis of our clients needs in the areas of retirement planning, investment, insurance, and estate planning. This gives our clients a clear picture of there current finances and how they can plan for the future. We have found that this focus on the fundamentals gives us the ability to create plans for our clients that help them thrive.

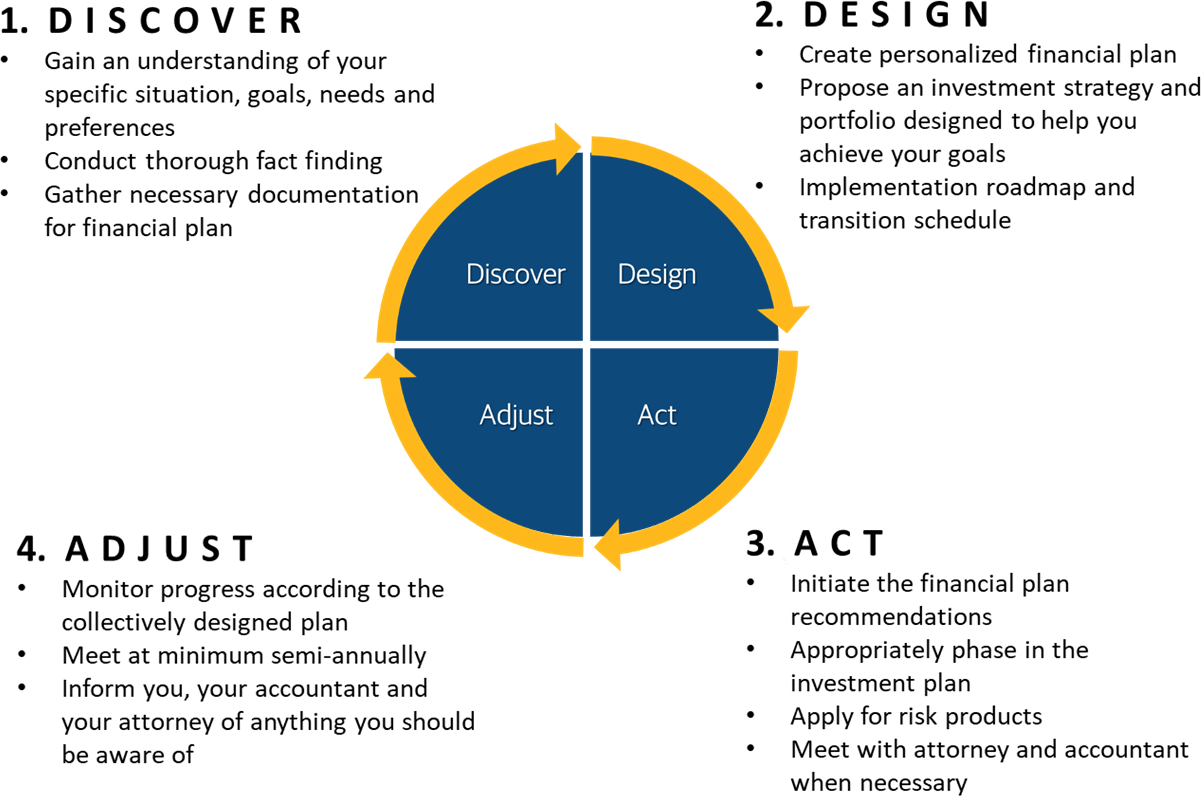

Our Comprehensive Financial Planning Process

Our planning process at GSG Wealth Management is a cycle that involves four steps: Discover, Design, Act, and Adjust. This allows us to create a plan that is firm enough to endure but nimble enough to adjust with our clients changing goals and needs.

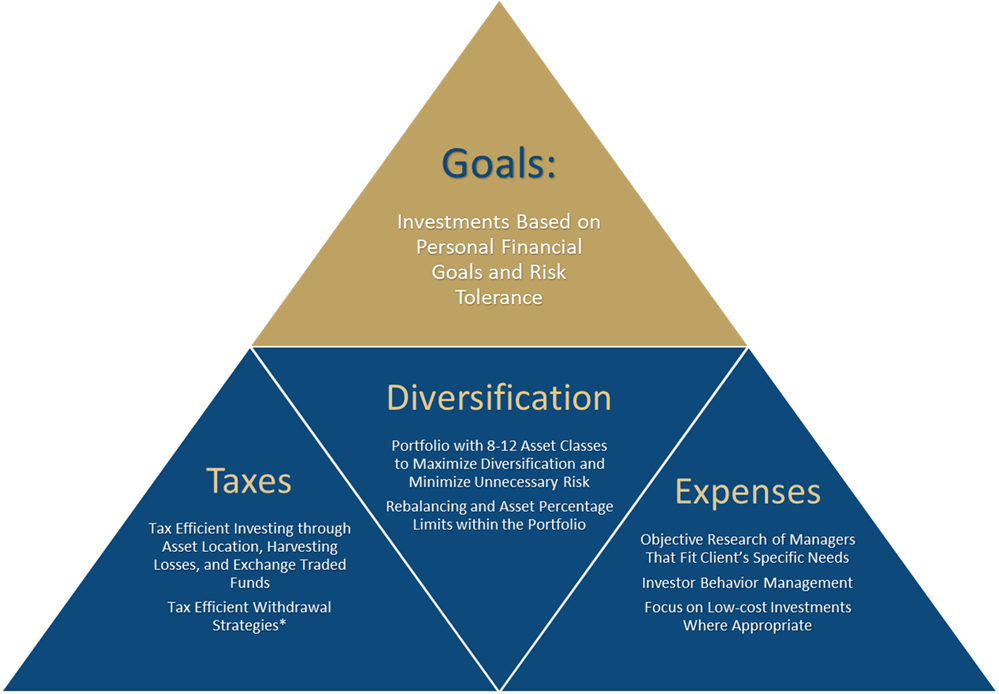

Wealth Management Philosophy

We help our clients compare investment options as an offensive strategy for financial planning. Our investment philosophy is to focus on what we can control in tax strategy, diversification, and expenses. This helps us build portfolios that have the balance of potential growth and security that our clients need.

ALL INVESTMENTS CARRY SOME LEVEL OF RISK INCLUDING THE POTENTIAL LOSS OF ALL MONEY INVESTED. NO INVESTMENT STRATEGY, INCLUDING TAX-LOSS HARVESTING, DIVERSIFICATION, REBALANCING, OR STRATEGIC ASSET ALLOCATION, CAN GUARANTEE A PROFIT OR PROTECT AGAINST LOSS. FINANCIAL REPRESENTATIVES DO NOT RENDER TAX ADVICE. CONSULT WITH A TAX PROFESSIONAL FOR TAX ADVICE THAT IS SPECIFIC TO YOUR SITUATION.

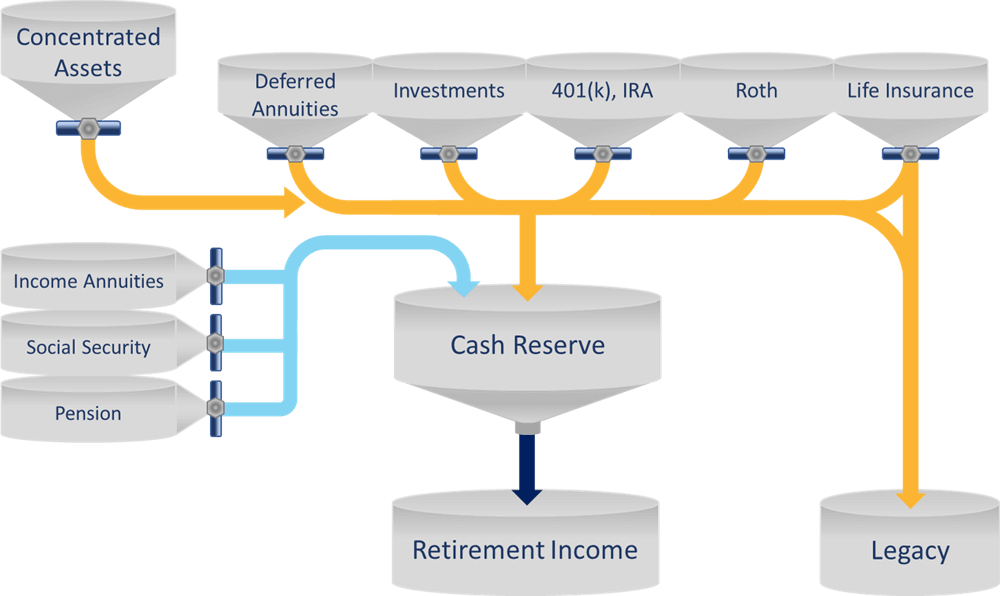

Retirement Planning

There is a nearly unlimited combination of ways in which you can plan for retirement.

- Investments

- Pension

- Deferred Annuity

- 401K/403b

- Social Security

- Life Insurance

- IRA

- Roth

- Income Annuity

Just using these tools, a couple has over 250,000 different possible strategies. We will help you clear the uncertainty and navigate your options to figure out what combination makes the most sense for your individual situation and your unique goals.

THE PRIMARY PURPOSE OF PERMANENT LIFE INSURANCE IS TO PROVIDE A DEATH BENEFIT. USING PERMANENT LIFE INSURANCE ACCUMULATED VALUE TO SUPPLEMENT RETIREMENT INCOME WILL REDUCE THE DEATH BENEFIT AND MAY AFFECT OTHER ASPECTS OF THE POLICY.

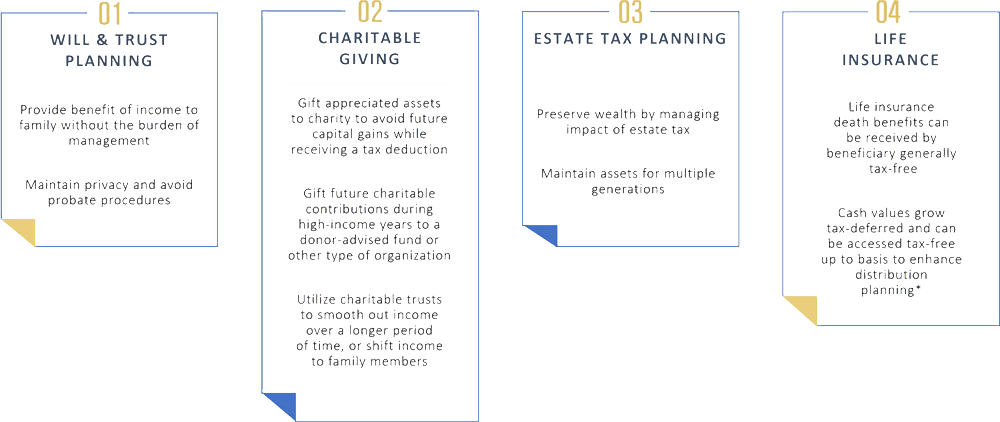

Estate Planning

Estate planning is about getting the right assets to the right people at the right time. Building a lasting legacy takes more than simply accumulating a large portfolio. An estate plan should provide details to help you efficiently transfer your assets during your life, as well as meet your end-of-life desires and obligations. We'll help you develop a plan to ensure your wishes are honored today and in the event of your incapacity or death.

We can help ensure your assets are managed according to your wishes while also carrying out tax strategies to keep more of the assets that you have worked so hard to accumulate.

UTILIZING THE CASH VALUE THROUGH POLICY LOANS, SURRENDERS, OR CASH WITHDRAWALS WILL REDUCE THE DEATH BENEFIT; AND MAY NECESSITATE GREATER OUTLAY THAN ANTICIPATED AND/OR RESULT IN AN UNEXPECTED TAXABLE EVENT.

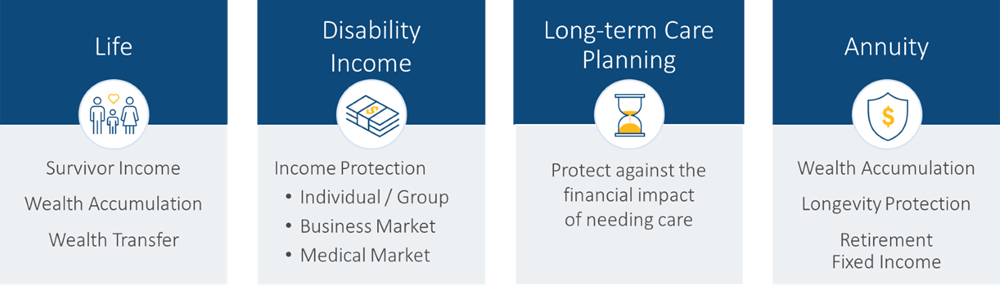

Insurance Planning

We help our clients compare insurance products as a defensive strategy for financial planning. Assets that take years to accumulate can be consumed in a fraction of that time. Imagine the impact if a breadwinner in your family became sick, disabled, was unable to work or died. What if a loved one required specialized care on an extended basis? A solid financial plan should be designed to protect you and your family against unforeseen and devastating events in life.

When working with us, you have access to world class insurance products from Northwestern Mutual and dozens of other companies. We'll help ensure you, your family and your income are adequately protected from risk.